2017 has seen a number of severe catastrophes take place across South Africa: the Knysna fires, floods in Johannesburg and Durban, the drought in the Western Cape, and numerous tornadoes across Gauteng. Not only did these disasters cause widespread damage, they also revealed a massive weakness in how prepared most South Africans are for unforeseen calamities.

According to recent statistics between 35 – 40% of South Africans with household contents insurance are generally underinsured by a large margin, a fact that could have far-reaching implications for policyholders and their families.

Many South Africans assume that if they have a home contents insurance policy in place, they will be covered if any of their possessions are lost, stolen or damaged, at least for the insured amount in case of a total loss. But this is not the case. If the policyholder is under-insured, the insurer will apply “Average” when calculating the claim settlement.

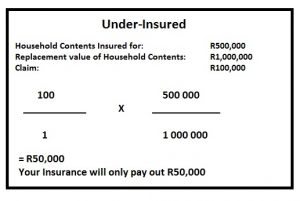

Average is an insurance principle that has exasperated many short-term insurance clients, yet it is a simple and straightforward insurance concept to understand. What it means is that if an item or property is underinsured, the insured must bear a rateable proportion of each and every loss. Basically, this means that in the event of a claim, the policyholder will receive less than it costs to replace or repair the item.

The formula determining average is as follows: · (Sum Insured / Value at Risk) x Amount of Loss

· (Sum Insured / Value at Risk) x Amount of Loss

Average is applied for three main reasons:

· To prevent underinsurance.

· To obtain a full premium for the risk the insurer is carrying.

· To ensure that each party bears a fair share of each loss.

It is important to also understand the term replacement value, the replacement value of goods is what it would cost you, at the time of a claim, to replace all your belongings with similar brand new ones. Cover is generally taken out on perceived value instead of the actual new replacement value, especially in the case of inherited or second-hand items that they didn’t pay a lot for in the first place, and this will impact both the policyholder and short-term insurers.